Why you need to check your KiwiSaver, now

It's that time of the year again. Yes, it comes around every June, every year. Yet, over 1 million Kiwis seem to forget, every year.

If I said to you, I will give you $8000 for 10 minutes of your time, would you say yes? I think anyone would! Well, that's what I am asking now. It takes less than 10 minutes to login to your KiwiSaver account and check your balance.

June is Member Tax Credit time. Otherwise known as ‘free money’ time. It's the time of year when the Government gives you $521 of free money if you have contributed $1042 or more per year into your KiwiSaver account.

So how do I get $8000? Well the MTC is only $521 today but that $521 invested for 35 years at 8% return (the average return of the stock market over the long term) is over $8000. This is due to the magic of compound interest.

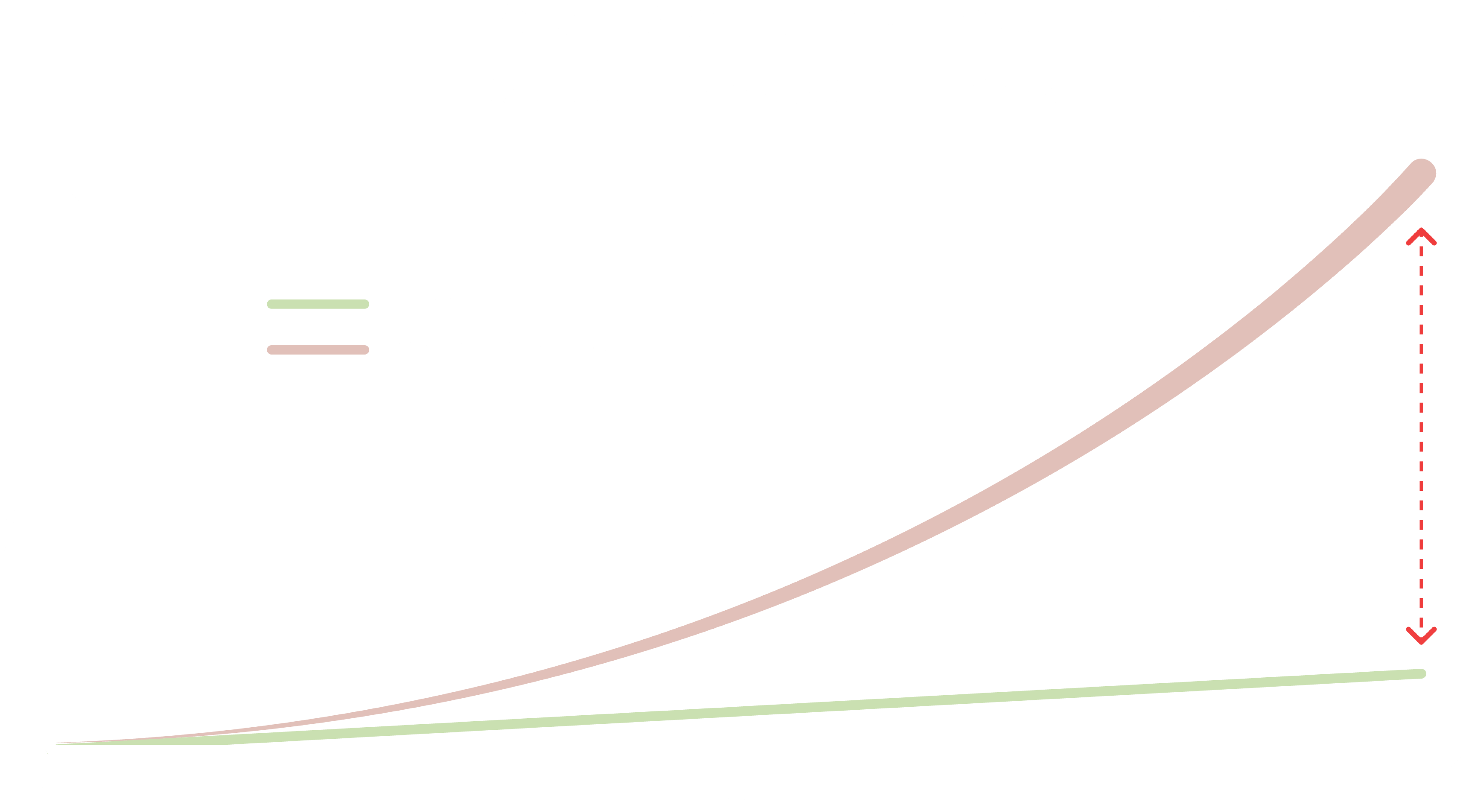

Compound interest is your investing best friend. It is interest on interest on interest. For example, if you invested $1 in the stock market and the stock market grew by 8%, you would have $1.08 in Year 1. Then in Year 2, the stock market returns another 8%, because you started from a higher base of $1.08 at the beginning of Year 2, your investment (despite it being the same % return as Year 1), is $1.67. Then the following year it is $1.26, then $1.36…you can see how the interest is ‘compounding’ on the previous year.

It makes your money grow and grow and grow. The longer you leave your money invested, the more it will grow. And the great thing with KiwiSaver, is that you are forced to leave it there - you’re forced to let your money grow! Amazing.

Compound interest is relevant outside of KiwiSaver too. The next time you are tossing up about spending that $100 on going out for dinner or investing it, just remember, it’s not JUST $100 you are spending. Due to compound interest, if you invest that $100 it is actually $1600 you are spring on dinner 😳

And if you miss out on that $521 EVERY YEAR, that is actually over $100,000 you are missing out on at retirement*. That’s over an entire year’s salary for some people!

The cut off date for your free money is the 30th June. You don’t have to apply for your free money though, you just have to check you have deposited $1042 or more this year (1st July - 30th June), and if not, transfer that amount now.

So do me a favour. Take out your phone, your diary or your calendar - whatever you use to remind you of things! And put a reminder in there for 1st June. This will give you pleeeenty of time and ensure there are no excuses. Don’t be one of those 400k people that miss out each year. Every little investment helps.

*Assuming you invest it at 8% return per year and have 35 years until retirement